Ultrasound Contrast Microbubble Engineering in 2025: Pioneering Innovations, Expanding Clinical Frontiers, and a Rapidly Accelerating Global Market. Discover How Next-Gen Microbubbles Are Transforming Diagnostic Imaging and Therapeutics.

- Executive Summary: Key Trends and 2025 Market Outlook

- Market Size, Growth Rate, and Forecasts Through 2030

- Technological Innovations in Microbubble Formulation and Delivery

- Regulatory Landscape and Approvals: 2025 Update

- Leading Companies and Strategic Partnerships (e.g., bracco.com, lantheus.com)

- Emerging Clinical Applications: Beyond Traditional Imaging

- Manufacturing Advances and Supply Chain Developments

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Barriers, and Unmet Needs in Microbubble Engineering

- Future Outlook: Disruptive Technologies and Market Opportunities to 2030

- Sources & References

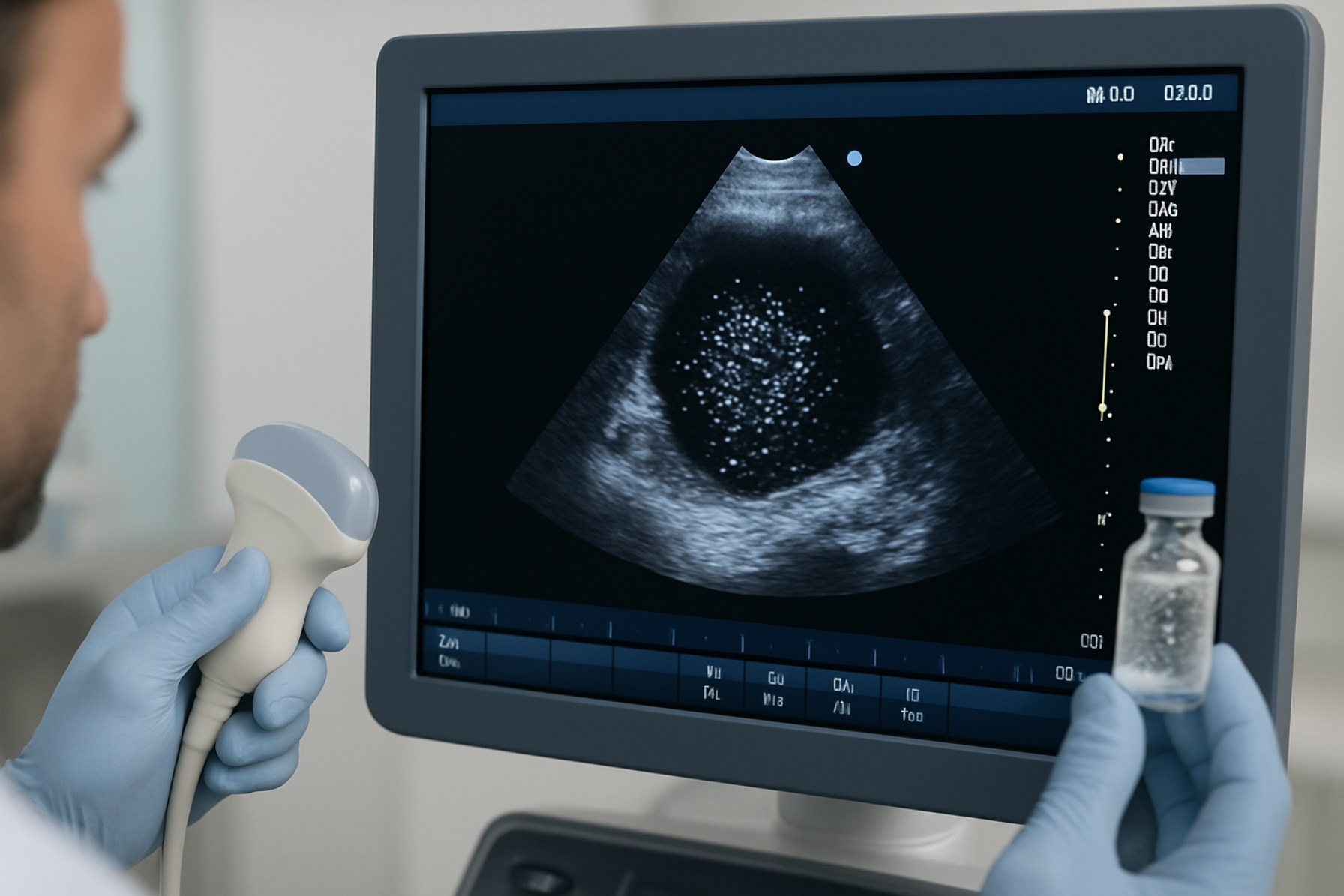

Executive Summary: Key Trends and 2025 Market Outlook

Ultrasound contrast microbubble engineering is undergoing rapid transformation as the global demand for advanced diagnostic imaging and targeted therapeutic delivery accelerates. In 2025, the sector is characterized by a convergence of innovation in microbubble formulation, regulatory momentum, and expanding clinical applications, particularly in cardiology, oncology, and liver imaging. The market is led by a handful of established players, including Bracco, GE HealthCare, and Lantheus Holdings, each investing in next-generation microbubble platforms and expanding their global reach.

Key trends shaping the industry include the refinement of microbubble shell materials and gas cores to improve stability, circulation time, and targeted delivery. Companies are increasingly focusing on phospholipid and polymer-based shells, as well as perfluorocarbon gases, to enhance echogenicity and safety profiles. For example, Bracco’s SonoVue and Lantheus Holdings’ Definity remain reference products, but both firms are actively developing new formulations with improved pharmacokinetics and molecular targeting capabilities.

Regulatory progress is also notable. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have expanded indications for ultrasound contrast agents, particularly for pediatric and liver imaging, which is expected to drive adoption in 2025 and beyond. Additionally, the emergence of microbubble-mediated drug and gene delivery is attracting significant R&D investment, with several early-phase clinical trials underway. Companies such as GE HealthCare are exploring microbubble platforms for theranostic applications, integrating diagnostic and therapeutic functions in a single agent.

From a market perspective, the Asia-Pacific region is anticipated to experience the fastest growth, driven by increasing healthcare infrastructure investment and rising awareness of non-invasive imaging modalities. Strategic partnerships between microbubble manufacturers and ultrasound equipment providers are also intensifying, as seen in collaborations involving GE HealthCare and Bracco, aimed at optimizing agent-device compatibility and workflow integration.

Looking ahead, the outlook for 2025 and the next few years is robust. The sector is poised for double-digit growth, underpinned by ongoing innovation, regulatory support, and expanding clinical utility. The next wave of microbubble engineering is expected to deliver agents with enhanced targeting, longer circulation, and multifunctional capabilities, positioning ultrasound contrast microbubbles as a cornerstone of precision imaging and therapy.

Market Size, Growth Rate, and Forecasts Through 2030

The global market for ultrasound contrast microbubble engineering is experiencing robust growth, driven by expanding clinical applications, technological advancements, and increasing adoption in both developed and emerging healthcare markets. As of 2025, the market is estimated to be valued at approximately $2.1 billion, with a compound annual growth rate (CAGR) projected between 8% and 11% through 2030. This growth trajectory is underpinned by rising demand for non-invasive diagnostic imaging, particularly in cardiology, oncology, and liver disease assessment.

Key industry players such as Bracco, Lantheus Medical Imaging, and GE HealthCare are at the forefront of innovation and commercialization. Bracco’s SonoVue (Lumason in the US) and Lantheus Medical Imaging’s Definity are among the most widely used microbubble contrast agents, with ongoing investments in expanding indications and improving safety profiles. These companies are also exploring next-generation microbubble formulations with targeted delivery and theranostic capabilities, which are expected to enter clinical trials within the next few years.

The Asia-Pacific region is anticipated to witness the fastest growth, fueled by increasing healthcare infrastructure investments and regulatory approvals in countries such as China and India. Meanwhile, North America and Europe continue to dominate the market due to established reimbursement frameworks and high adoption rates of advanced imaging modalities. Regulatory agencies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), have recently expanded approved indications for microbubble contrast agents, further accelerating market penetration.

Looking ahead to 2030, the ultrasound contrast microbubble engineering sector is expected to benefit from several converging trends:

- Integration of artificial intelligence and advanced imaging software to enhance microbubble detection and quantification.

- Development of microbubbles with multifunctional properties, such as drug delivery and molecular imaging.

- Broader clinical adoption in point-of-care and portable ultrasound systems, supported by companies like GE HealthCare.

- Increased collaboration between industry and academic research centers to accelerate translational research and regulatory approvals.

Overall, the ultrasound contrast microbubble engineering market is poised for sustained expansion through 2030, with innovation, regulatory support, and global healthcare trends driving both volume and value growth.

Technological Innovations in Microbubble Formulation and Delivery

The field of ultrasound contrast microbubble engineering is experiencing rapid technological advancements as of 2025, driven by the need for improved diagnostic accuracy, targeted drug delivery, and enhanced safety profiles. Microbubbles, typically composed of a gas core encapsulated by a stabilizing shell, are being re-engineered with novel materials and functionalization strategies to optimize their performance in clinical and preclinical settings.

A major trend is the refinement of shell materials. Traditional phospholipid and protein shells are now being supplemented or replaced by advanced polymers and hybrid composites, which offer greater stability and tunable acoustic properties. For example, companies such as Bracco and Lantheus—both leading manufacturers of FDA-approved ultrasound contrast agents—are investing in next-generation shell chemistries to extend microbubble circulation time and reduce immunogenicity. These innovations are expected to facilitate longer imaging windows and more precise molecular targeting.

Another significant innovation is the development of targeted microbubbles. By conjugating ligands, antibodies, or peptides to the microbubble surface, researchers are enabling site-specific binding to biomarkers associated with diseases such as cancer, cardiovascular disorders, and inflammation. This approach is being actively explored by industry leaders and academic collaborators, with Bracco and Lantheus both reporting ongoing research into targeted formulations for clinical translation.

Microbubble size uniformity and monodispersity are also critical for consistent acoustic response and safety. Recent advances in microfluidic manufacturing, as adopted by several suppliers, allow for precise control over microbubble diameter and shell thickness. This not only improves reproducibility but also enables the customization of microbubbles for specific imaging frequencies and therapeutic applications.

On the delivery front, integration with advanced ultrasound systems is a key focus. Companies such as GE HealthCare and Philips are collaborating with microbubble developers to optimize imaging protocols and real-time feedback mechanisms, ensuring that microbubble administration is synchronized with imaging for maximal diagnostic yield.

Looking ahead, the next few years are expected to see the emergence of multifunctional microbubbles capable of both imaging and therapy (theranostics), as well as the first clinical trials of microbubble-mediated drug and gene delivery. Regulatory pathways are also evolving, with industry stakeholders working closely with agencies to establish standards for safety, efficacy, and manufacturing quality. These technological innovations are poised to expand the clinical utility of ultrasound contrast microbubbles well beyond traditional diagnostic imaging.

Regulatory Landscape and Approvals: 2025 Update

The regulatory landscape for ultrasound contrast microbubble agents is evolving rapidly in 2025, reflecting both technological advances and growing clinical demand. Microbubble-based ultrasound contrast agents (UCAs) are subject to rigorous oversight, primarily by agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and comparable authorities in Asia-Pacific regions. These agents, composed of gas-filled microspheres encapsulated by lipid, protein, or polymer shells, are classified as drugs or drug-device combinations, necessitating comprehensive safety and efficacy data for approval.

In the United States, the FDA has continued to expand indications for existing microbubble agents, such as those produced by Bracco and Lantheus. Bracco’s Lumason® (marketed as SonoVue® in Europe) and Lantheus’ Definity® remain the only FDA-approved UCAs for echocardiography, with recent label expansions to include pediatric and liver imaging. In 2024 and early 2025, both companies have submitted supplemental applications for new clinical indications, including targeted molecular imaging and perfusion assessment in oncology, reflecting the growing body of clinical evidence supporting broader use.

The EMA has similarly updated its guidance, with a focus on harmonizing safety monitoring and post-market surveillance across member states. The agency has encouraged the development of next-generation microbubbles with targeted or theranostic capabilities, and several investigational agents are in late-stage clinical trials. Notably, Bracco and Bayer are leading European efforts, with Bayer’s R&D pipeline including microbubble formulations designed for both diagnostic and therapeutic ultrasound applications.

In Asia, regulatory agencies in Japan and China have accelerated review pathways for innovative UCAs, recognizing their potential in cancer diagnostics and cardiovascular imaging. Companies such as Daiichi Sankyo in Japan and Shineway in China are actively developing and commercializing microbubble agents tailored to regional clinical needs.

Looking ahead, the regulatory outlook for 2025 and beyond is characterized by increasing collaboration between industry and regulators to establish standards for novel microbubble formulations, including those with drug delivery and gene therapy capabilities. The FDA and EMA are expected to issue updated guidance on the evaluation of targeted and multifunctional UCAs, with a focus on long-term safety, immunogenicity, and real-world effectiveness. As the field advances, regulatory harmonization and adaptive approval pathways will be critical to bringing next-generation microbubble technologies to clinical practice worldwide.

Leading Companies and Strategic Partnerships (e.g., bracco.com, lantheus.com)

The field of ultrasound contrast microbubble engineering is currently shaped by a select group of leading companies, each leveraging proprietary technologies and strategic partnerships to advance both clinical and preclinical applications. As of 2025, the competitive landscape is dominated by established players such as Bracco and Lantheus, both of which have a long-standing presence in the development and commercialization of ultrasound contrast agents.

Bracco, headquartered in Italy, is recognized for its flagship product, SonoVue (marketed as Lumason in the United States), a sulfur hexafluoride microbubble contrast agent. Bracco continues to invest in next-generation microbubble formulations, focusing on improved stability, targeted delivery, and enhanced imaging capabilities. The company has also expanded its R&D collaborations with academic institutions and biotech startups to explore microbubble-mediated drug delivery and theranostic applications, signaling a shift toward multifunctional agents.

Lantheus, based in the United States, markets Definity, a perflutren lipid microsphere agent widely used in echocardiography. Lantheus has recently announced partnerships with device manufacturers and research consortia to develop microbubbles tailored for molecular imaging and site-specific therapy. Their strategic focus includes leveraging artificial intelligence for real-time image analysis and optimizing microbubble formulations for emerging clinical indications, such as oncology and vascular disease.

Beyond these market leaders, several other companies are making significant contributions. GE HealthCare and Siemens Healthineers are actively involved in integrating advanced microbubble contrast agents with their ultrasound imaging platforms, aiming to provide end-to-end solutions for diagnostic and interventional procedures. These collaborations often involve co-development agreements with microbubble manufacturers to ensure compatibility and regulatory compliance.

Strategic partnerships are increasingly central to innovation in this sector. Companies are forming alliances with academic research centers, contract manufacturing organizations, and pharmaceutical firms to accelerate the translation of novel microbubble technologies from bench to bedside. For example, joint ventures are focusing on the development of targeted microbubbles for site-specific drug delivery, leveraging advances in ligand conjugation and nanotechnology.

Looking ahead, the next few years are expected to see intensified collaboration between industry leaders and emerging biotech firms, particularly in the areas of personalized medicine and theranostics. Regulatory agencies are also engaging with manufacturers to streamline approval pathways for new microbubble formulations, which is likely to further stimulate innovation and market growth.

Emerging Clinical Applications: Beyond Traditional Imaging

Ultrasound contrast microbubble engineering is rapidly advancing, enabling a new generation of clinical applications that extend well beyond traditional vascular imaging. In 2025 and the coming years, the field is witnessing a shift toward multifunctional microbubbles designed for targeted drug delivery, molecular imaging, and theranostics—integrating therapy and diagnostics in a single platform.

One of the most promising developments is the engineering of microbubbles with surface ligands that bind to specific molecular markers, allowing for highly selective imaging of pathological tissues such as tumors or inflamed endothelium. Companies like Bracco and Lantheus, both established leaders in ultrasound contrast agents, are investing in research to functionalize microbubbles for targeted imaging and therapy. For example, Bracco’s SonoVue® microbubbles are being explored in preclinical and early clinical studies for their potential to carry therapeutic payloads or target specific disease biomarkers.

Another emerging application is ultrasound-mediated drug delivery, where microbubbles are engineered to encapsulate drugs or genetic material. Upon exposure to focused ultrasound, these microbubbles can be selectively ruptured at the target site, releasing their payload and enhancing local drug uptake. This approach is being actively investigated for oncology, neurology, and cardiovascular diseases. Lantheus (with its Definity® microbubbles) and Bracco are both developing next-generation formulations to optimize payload capacity and stability, while startups and academic spinouts are exploring novel shell materials and surface chemistries to improve targeting and safety.

In addition, microbubble engineering is enabling new frontiers in blood-brain barrier (BBB) modulation. By combining microbubbles with focused ultrasound, researchers can transiently open the BBB, allowing therapeutics to reach the brain—a major challenge in treating neurodegenerative diseases and brain tumors. Several clinical trials are underway, and industry players are collaborating with academic centers to refine microbubble formulations for this purpose.

Looking ahead, the next few years are expected to bring regulatory milestones and expanded clinical adoption of engineered microbubbles for these advanced applications. The integration of artificial intelligence for real-time imaging analysis and microbubble tracking is also anticipated, further enhancing precision and safety. As companies like Bracco and Lantheus continue to innovate, the clinical landscape for ultrasound contrast microbubbles is poised for significant transformation, moving well beyond traditional imaging into the realms of precision medicine and minimally invasive therapy.

Manufacturing Advances and Supply Chain Developments

The landscape of ultrasound contrast microbubble engineering is undergoing significant transformation in 2025, driven by advances in manufacturing technologies and evolving supply chain strategies. Microbubble contrast agents, essential for enhancing ultrasound imaging, are increasingly being produced with greater precision, scalability, and regulatory compliance. This progress is largely attributed to the integration of microfluidic manufacturing, automation, and improved quality control systems.

Key industry players such as Bracco and GE HealthCare continue to lead in the development and supply of clinically approved microbubble agents. Bracco, for example, manufactures SonoVue/Lumason, a sulfur hexafluoride microbubble agent widely used in echocardiography and liver imaging. The company has invested in expanding its production facilities and implementing advanced process controls to ensure consistent product quality and meet growing global demand. Similarly, GE HealthCare supplies Optison, an FDA-approved perflutren protein-type A microsphere, and has focused on optimizing its supply chain to ensure reliable distribution to healthcare providers worldwide.

Recent years have seen a shift toward microfluidic-based manufacturing, which allows for the production of monodisperse microbubbles with tightly controlled size distributions. This technology not only improves the safety and efficacy of contrast agents but also enhances batch-to-batch reproducibility. Companies are increasingly adopting closed-system, automated production lines to minimize contamination risks and streamline regulatory compliance, particularly in response to stricter guidelines from agencies such as the FDA and EMA.

Supply chain resilience has become a focal point, especially in the wake of global disruptions experienced in recent years. Manufacturers are diversifying their raw material sources and establishing regional production hubs to mitigate risks associated with transportation delays and geopolitical uncertainties. For instance, Bracco has reported efforts to localize certain aspects of its supply chain, ensuring uninterrupted access to critical components such as phospholipids and gases used in microbubble formulation.

Looking ahead, the next few years are expected to bring further integration of digital supply chain management tools, including real-time tracking and predictive analytics, to optimize inventory and distribution. The ongoing collaboration between manufacturers, raw material suppliers, and regulatory bodies is anticipated to accelerate the introduction of next-generation microbubble agents with enhanced targeting and therapeutic capabilities. As the demand for advanced ultrasound imaging grows, the sector is poised for continued innovation in both manufacturing and supply chain logistics, ensuring that high-quality microbubble contrast agents remain accessible to clinicians and patients worldwide.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for ultrasound contrast microbubble engineering is marked by distinct regional trends, shaped by regulatory environments, healthcare infrastructure, and the presence of leading manufacturers. As of 2025, North America, Europe, and Asia-Pacific are the primary hubs for innovation and commercialization, while the Rest of World (RoW) region is experiencing gradual adoption.

North America remains at the forefront, driven by robust R&D investment, a favorable regulatory climate, and the presence of major industry players. The United States, in particular, benefits from the activities of companies such as Bracco and Lantheus Medical Imaging, both of which have FDA-approved ultrasound contrast agents and are actively developing next-generation microbubble formulations. The region’s academic institutions and medical centers are also engaged in translational research, focusing on targeted microbubble delivery and theranostic applications. The U.S. market is expected to maintain its leadership due to ongoing clinical trials and early adoption of advanced imaging protocols.

Europe is characterized by a strong regulatory framework and a collaborative research environment. The European Medicines Agency (EMA) has approved several microbubble agents, and companies such as Bracco (with significant operations in Italy and Switzerland) and Bayer are prominent in the region. European research consortia are advancing microbubble engineering for both diagnostic and therapeutic purposes, with a particular emphasis on cardiovascular and oncological imaging. The region is also seeing increased investment in microbubble manufacturing capabilities, aiming to meet growing clinical demand and support export to emerging markets.

Asia-Pacific is rapidly emerging as a key growth area, fueled by expanding healthcare infrastructure and rising demand for advanced diagnostic tools. Japan and China are leading the region, with companies such as Daiichi Sankyo and Shinopharm (China ShinoPharm) investing in both local production and R&D. Regulatory approvals in China and Japan have accelerated market entry, and collaborations with Western firms are facilitating technology transfer. The region is expected to see the fastest growth in microbubble adoption over the next few years, particularly in liver and cardiac imaging.

Rest of World (RoW) markets, including Latin America, the Middle East, and Africa, are at earlier stages of adoption. Access to microbubble contrast agents is limited by regulatory hurdles and cost constraints, but pilot programs and partnerships with global manufacturers are beginning to address these barriers. As local healthcare systems modernize, gradual uptake is anticipated, especially in urban centers and private healthcare networks.

Overall, the next few years will likely see continued North American and European leadership in innovation, with Asia-Pacific driving volume growth and RoW regions incrementally expanding access to ultrasound contrast microbubble technologies.

Challenges, Barriers, and Unmet Needs in Microbubble Engineering

The field of ultrasound contrast microbubble engineering is advancing rapidly, yet several significant challenges, barriers, and unmet needs persist as of 2025. These issues span the entire value chain, from microbubble formulation and manufacturing to clinical translation and regulatory approval.

A primary technical challenge remains the precise control of microbubble size, shell composition, and stability. Microbubbles must be engineered to be small enough (typically 1–10 microns) to pass safely through the pulmonary capillaries, while maintaining sufficient stability to persist in circulation and provide strong echogenicity. Achieving this balance is complicated by the inherent fragility of microbubbles and the need for reproducible, scalable manufacturing processes. Leading manufacturers such as Bracco and Lantheus have developed proprietary formulations (e.g., sulfur hexafluoride or perflutren gas cores with phospholipid or protein shells), but further improvements in shelf-life, batch-to-batch consistency, and resistance to in vivo degradation are ongoing priorities.

Another barrier is the limited functionalization of microbubbles for targeted imaging or therapeutic delivery. While research groups and companies are exploring ligand-conjugated microbubbles for molecular imaging or drug delivery, challenges include ensuring ligand stability, avoiding immunogenicity, and maintaining microbubble integrity during circulation and ultrasound exposure. The translation of these advanced microbubbles from preclinical models to human use is hampered by complex regulatory requirements and the need for robust safety and efficacy data.

Regulatory pathways for novel microbubble agents remain a significant hurdle. Agencies such as the U.S. Food and Drug Administration (FDA) require comprehensive data on pharmacokinetics, biodistribution, and potential toxicity, particularly for microbubbles with new shell materials or active targeting moieties. This increases development timelines and costs, and can deter smaller companies or academic spinouts from entering the market. Even established players like Bracco and Lantheus face lengthy approval processes for new indications or formulations.

Unmet clinical needs also persist. Current microbubble agents are primarily approved for cardiac and hepatic imaging, with limited adoption in other applications such as oncology, neurology, or targeted drug delivery. There is a demand for microbubbles that can cross biological barriers (e.g., the blood-brain barrier) or deliver therapeutics in a controlled manner, but these remain largely experimental. Additionally, the lack of standardized protocols for microbubble administration and imaging, as well as limited physician training, further restricts broader clinical uptake.

Looking ahead, addressing these challenges will require coordinated efforts between industry leaders, regulatory bodies, and academic researchers. Advances in materials science, microfluidic manufacturing, and molecular engineering are expected to drive the next generation of microbubble agents, but overcoming current barriers will be essential for realizing their full clinical potential.

Future Outlook: Disruptive Technologies and Market Opportunities to 2030

The landscape of ultrasound contrast microbubble engineering is poised for significant transformation through 2030, driven by advances in materials science, targeted delivery, and regulatory momentum. As of 2025, the global market is witnessing a surge in research and commercial activity, with established players and innovative startups accelerating the development of next-generation microbubble agents for both diagnostic and therapeutic applications.

Key industry leaders such as Bracco and GE HealthCare continue to expand their portfolios of ultrasound contrast agents, focusing on improved stability, longer circulation times, and enhanced safety profiles. Bracco’s SonoVue and GE HealthCare’s Optison remain among the most widely used agents, but both companies are investing in R&D to engineer microbubbles with functionalized shells for molecular imaging and site-specific drug delivery. These efforts are supported by collaborations with academic institutions and clinical centers, aiming to bring precision medicine closer to routine clinical practice.

Emerging technologies are set to disrupt the field. Lipid- and polymer-shelled microbubbles, as well as nanobubble formulations, are under active investigation for their potential to cross biological barriers and deliver therapeutics directly to tumors or inflamed tissues. Companies such as Lantheus are exploring microbubble platforms that can be conjugated with ligands or antibodies, enabling real-time visualization of disease biomarkers and targeted therapy. The integration of artificial intelligence with ultrasound imaging systems is also anticipated to enhance the detection and quantification of microbubble signals, improving diagnostic accuracy and workflow efficiency.

Regulatory agencies in the US, EU, and Asia are increasingly receptive to novel microbubble technologies, as evidenced by recent approvals and ongoing clinical trials. The FDA’s support for fast-track designations and breakthrough device pathways is expected to accelerate the introduction of advanced agents, particularly those with theranostic capabilities. Meanwhile, organizations such as EchoGen are developing microbubble formulations tailored for cardiovascular and oncological imaging, with several candidates in late-stage development.

Looking ahead to 2030, the market is likely to see a proliferation of personalized microbubble agents, integration with other imaging modalities, and expansion into new therapeutic areas such as gene delivery and immunotherapy. Strategic partnerships between device manufacturers, pharmaceutical companies, and biotechnology firms will be crucial in overcoming technical and regulatory hurdles. As the technology matures, ultrasound contrast microbubble engineering is expected to play a pivotal role in non-invasive diagnostics and targeted therapies, opening substantial market opportunities and reshaping the future of medical imaging.